|

News | Iran Travels | Iran Professional Services | About | Contact | Discussion Forum | Archive |

|

HAMSAYEH.NET |

| IRAN & INTERNATIONAL NEWS | CONTACT | ABOUT |

|

|

Global Stock Markets Plunge | ||

|

|

|||

|

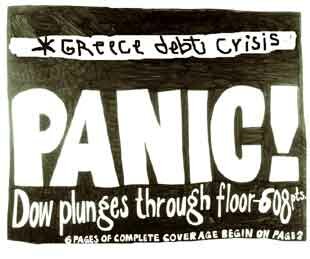

Panic strikes global stock markets following crisis in Greece, Spain and Portugal.

May 07, 2010 (Hamsayeh.Net) - World stock markets have plunged again in yesterday’s trading with concerns over Greek debt crisis still lingering.

One of the biggest slumps occurred on Wall Street where the Dow Jones industrial average dropped over 1000 points or around 10 percent in early hours of trading. DJ was able to regain some its losses after outside interventions helped recover the stock artificially by about 600 points and closing the market at 3.2 percent loss by the end of the day.

Dow’s troubles caused losses in Asian stocks with Japan’s Nikkei plunging four percent in its first 15 minutes of trading and closing lower by 3.1 percent. Sydney, Hong Kong, Seoul, Shanghai and all other markets in Asia plunged following US losses.

Market analysts in South Korea picture the situation as in a state of panic due to fears that troubles in Greece could spread to other countries including Spain and Portugal very soon. Both Spain and Portugal have huge international debts close to their GDP’s.

The problem is if the European Union begins massive emergency funds for Greece of over 100 billion euros, next bailouts for Spain and Greece would dwarf the current bailout because of sheer debt size.

But a failure to provide other emergency funds for Portugal and Spain would end up triggering a ripple effect on the global economy.

|

Failure to provide other emergency funds for Portugal and Spain would end up triggering a ripple effect on the global economy.

|

||

Disclaimer: Opinions expressed on this site are solely Hamsayeh.Net’s own and do not represent any official institutions’, bodies’, organizations’ etc. Similarly, Hamsayeh.Net

would not be responsible for any other opinions that may be expressed therein by other sources through direct or indirect quotations.