There are some small indications that the economy is turning around. Housing permits are increasing, car sales are going up. Good news; however, if the economy is turning around it might be short lived if investors believe that Oil speculation is the place to put their money.

One of the main reasons that the economy stumbled a year ago was because the American public could not support $150 barrel oil for long. This was proven when oil fell to its normal trading level of $40 a barrel and remained between $40 and $60 a barrel for over 6 months.

Now, with the hint of good economic news, oil speculation is going backup. Today oil has risen over $2 a barrel and is trading around $72 and looks as if there is no stopping it. Even the fact of record storage amount and ample supply does not derail this monster.

If oil continues to advance at this rate it will be sitting at $150 by spring of next year. Once again, gas will be over $4 a gallon and that will deplete disposable income again. However, this time, the shock it will be worse than ever.

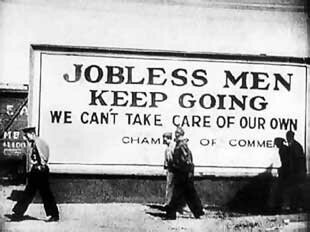

That is because, more than twice the number of people is out of work, than there was 18 months ago and that is not including those people who are considered long term unemployed and have not found a job and are no longer receiving unemployment. Therefore, the 9.5% unemployment rate is lower that what it is.

The credit market has tightened up also. Before, many people used credit cards to pay for gas and since then credit tightened up. Over the past 18 months, credit card companies were quick to reduce credit limits or even close accounts of good customers who pay on time and for those who remain behind, they will not consider extending credit.

Lastly, with very little exception the food prices have not retracted because of the high fuel prices from before. That means, if the price for energy goes higher, food prices will follow. When all of these conditions are added together are going to get hit with a triple whammy and whatever recovery that is in the works will be lost very quickly and it will not stop there.

This United States economy will do a rerun of where it was 18 months ago; however, this time we will only add to trouble that have not been resolved yet. When fuel goes above $4, everyone will see more companies begin to layoff employees because they have already cut as much as they can.

Big corporations will not be the only ones starting the layoffs. Small businesses that are barely keeping their head above water will go under as any profit that they have now will evaporate. Accounts Receivables that once were 30 to 40 on average to pay are now 50 to 60 a day. Therefore, many small businesses are only doing well on paper. Hard earn cash in the bank is not there and with the tightening credit market? Here outcome is questionable at best.

Whatever recovery is on the way might be short lived if energy cost continues to rise. These are unprecedented times we are facing; there's no proven economic model for these factors. Therefore, nobody can say for any certainty when we can expect things recover.

Source: Kurt Hodapp (eZine)

August 20, 2009

MSN - - - Wikipedia - Hamsayeh.Net