|

News | Iran Travels | Iran Professional Services | About | Contact | Discussion Forum | Archive |

|

HAMSAYEH.NET |

| IRAN & INTERNATIONAL NEWS | CONTACT | ABOUT |

|

|

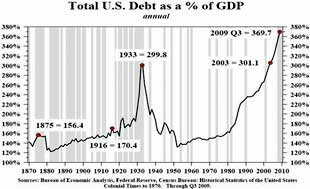

The Giant Debt Bubble to Pop Soon | ||

|

|

|||

|

The U.S. economy is being driven off a cliff, but America's "ruling class" has insisted all along that they know better than we do. July 21, 2010 The Economic Collapse Today most Americans are completely obsessed with the silliest of things. They wonder how Lindsay Lohan is going to fare in jail and they agonize over who LeBron James is going to play basketball for. But when it comes to the things that really matter, most Americans are completely clueless. For example, while most Americans would agree that we are experiencing difficult economic times right now, most of them would also argue that our economic system is in fundamentally good shape and that things will get back to "normal" at some point. Those of us who are trying to warn America of the impending economic nightmare are dismissed as "doom and gloomers" and "conspiracy theorists". But of course, as with so many things, the passage of time will tell who was right and who was wrong. Below there is a chart that I want all of you to burn into your memory. It is a chart of total U.S. debt as a percentage of GDP from 1870 until 2009. This chart clearly and succinctly communicates the horror of the debt bubble that we are currently dealing with. When this debt bubble pops, it is going to make the Great Depression look like a Sunday picnic. As you can see from the chart, the total of all debt (government, business and consumer) is now somewhere in the neighborhood of 360 percent of GDP. Never before has the United States faced a debt bubble of this magnitude. Most of us were not alive during the Great Depression, but those who were remember how incredibly painful it was for America to deleverage and bring the economic system back into some type of balance. So if our current debt bubble is far worse, what kind of economic horror is ahead for us? But the truth is that we are facing some circumstances that even the folks back during the Great Depression did not have to deal with.... 1 - Back in the 1930s, tens of millions of Americans lived on farms or knew how to grow their own food. Today the vast majority of Americans are totally dependent on the system for even their most basic needs. 2 - A vast horde of Baby Boomers is expecting to retire, and the "Social Security trust fund" has nothing but 2.5 trillion dollars of government IOUs in it. According to an official U.S. government report, rapidly growing interest costs on the U.S. national debt together with spending on major entitlement programs such as Social Security and Medicare will absorb approximately 92 cents of every dollar of federal revenue by the year 2019. This is a financial tsunami the likes of which Americans back in the 1930s could never have even dreamed of. 3 - American workers never had to compete for jobs with workers on the other side of the world back in the 1930s. But today, millions upon millions of our jobs have been "outsourced" to China, India and a vast array of third world nations where desperate workers are more than happy to slave away for big global corporations for less than a dollar an hour. How in the world are American workers supposed to compete with that? 4 - Back in the 1930s, there was nothing like the gigantic derivatives bubble that hangs over us today. The total value of all derivatives worldwide is estimated to be somewhere between 600 trillion and 1.5 quadrillion dollars. The danger that we face from derivatives is so great that Warren Buffet has called them "financial weapons of mass destruction". When this bubble pops there won't be enough money in the entire world to fix it. 5 - During the Great Depression, the United States economy was relatively self-contained. But today we truly do live in a global economy. Unfortunately that means that a severe economic crisis in one part of the world is going to affect us as well. Right now, the United States is far from alone in dealing with a massive debt crisis. Greece, Spain, Italy, Hungary, Portugal and a number of other European nations are in real danger of actually defaulting on their debts. Japan (the third biggest economy in the world) is on the verge of complete and total economic collapse. So what happens to the U.S. economy when the dominoes start to fall? The truth is that by almost any measure, we are in worse economic condition than we were right before the beginning of the Great Depression. We have been living way beyond our means and the debts we have been piling up are clearly not anywhere close to sustainable. Did you think that we could just continue to run deficits equal to 10 percent of GDP forever? Of course not. The U.S. economy is being driven off a cliff, but America's "ruling class" has insisted all along that they know better than we do. But the truth is that in the final analysis it is not us that they care about. What they do actually care about is getting more money and more power for themselves and for other members of the ruling class. Today, 10,000 people make 30% of the total income in the United States each year. That leaves 70% of the pie for the remaining 99.99% of us to divide up. The reality is that however you want to slice it, the U.S. economic system is broken. However, considering the fact that America's ruling class has a stranglehold on both major political parties, we are not likely to see any fundamental changes any time soon. That is very unfortunate, because time is running out on the U.S. economy.

|

Total U.S. debt as a percentage of GDP from 1870 until 2009

|

||

Disclaimer: Opinions expressed on this site are solely Hamsayeh.Net’s own and do not represent any official institutions’, bodies’, organizations’ etc. Similarly, Hamsayeh.Net

would not be responsible for any other opinions that may be expressed therein by other sources through direct or indirect quotations.