|

News | Iran Travels | Iran Professional Services | About | Contact | Discussion Forum | Archive |

|

HAMSAYEH.NET |

| IRAN & INTERNATIONAL NEWS | CONTACT | ABOUT |

|

|

IT'S UP TO CHINA NOW

|

||

|

|

|||

|

What China is awakening to is that their pile of US government debt is actually so huge now that it is impossible for them to actually buy much with it. The Dollar Vigilante August 31, 2010 In a huge sea change, China has been reducing the amount of exposure it has to American sovereign debt. But there is just one problem: they have so much American debt that it's nearly impossible to get rid of it all. And certainly without causing the US Dollar to drop to zero, overnight, leaving China without one of its largest trading partners and a pile of worthless paper.

China has been buying up assets and looking to diversify their huge reserves all over the world. They even bought over $8 billion of soon to be worthless Japanese government bonds in May - quadruple the amount they normally buy. Clearly they are scrambling for alternatives to US debt to store their huge amount ($2.4 trillion) of reserves. It should be noted, however, that most of its investment in Japanese bonds all went into very short-term bonds such as 90 day notes. Clearly they know that sitting there too long is dangerous as well.

What China is awakening to is that their pile of US government debt is actually so huge now that it is impossible for them to actually buy much with it. That is because as soon as they start to sell significant quantities the US dollar will collapse almost overnight.

The Chinese State Administration of Foreign Exchange recently stated, "Gold is globally recognized as a store of value and can be used for urgent payment, but... it cannot become a main channel for investing our foreign exchange reserves."

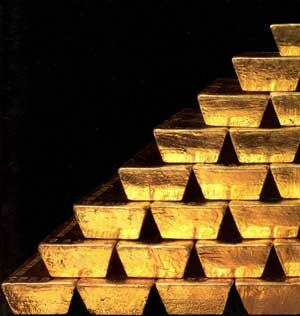

Translation: “We have so many dollars that we would absolutely overwhelm the gold market if we tried to use our reserves to buy gold.” After all, a rough guesstimate of all the gold in the world adds up to about 10 billion ounces (an amount that all combined would form a cube only about 83 feet per side). 10 billion ounces of gold at recent prices means all the gold in the world is only worth $12 trillion. Therefore, if China were to use all their reserves today to buy gold at today's prices they would buy up nearly 25% of all the gold in existence.

And so they are right, they currently are not able to convert all their reserves into gold because it would be impossible to buy that percentage of all gold without turning the market for gold into complete chaos. But that presumes that current prices stay where they are. There will, very soon, come a day where they can use all their US Dollars to buy gold and it won't make a massive impact on the gold market. How? In the near future gold will be trading for anywhere from $5,000 to $10,000 and upwards per ounce. This means that China's $2.4 trillion will then only buy 2.5%-5% of all gold in existence, a number which is feasible and, in our opinion, a highly likely outcome.

|

In the near future gold will be trading for anywhere from $5,000 to $10,000 and upwards per ounce.

|

||

Disclaimer: Opinions expressed on this site are solely Hamsayeh.Net’s own and do not represent any official institutions’, bodies’, organizations’ etc.

Similarly, Hamsayeh.Net would not be responsible for any other opinions that may be expressed therein by other sources through direct or indirect quotations.